Tax Amendments/Changes in Budget 2018-19 for Companies and for Individuals

Tax Structure in India (Introduction)

In India, the tax is the biggest source of revenue for the Government and has always been a matter of focus in every year’s budget. Taxes in India have been categorized as either Direct Tax or Indirect Tax based on the procedure of collecting the same. Direct taxes are the ones that are collected directly from the individuals, companies, or corporates and whereas indirect taxes are collected indirectly through any intermediary or are a type of tax that is not paid by someone to the authorities and is actually passed on to the other in the form of increased cost. Some of the key direct taxes include income tax, corporate tax, capital gains tax, etc. and whereas some important indirect taxes are sales tax, excise duty, customs duty, etc.

Further, the tax system in India has been divided into two parts –

Tax by Central Govt.: Income tax, corporate tax, custom duty and

Tax by state Govt.: Land revenue tax, stamp duty, agriculture income tax etc.

One of the major tax reforms that happened recently, was Goods and service tax (GST) with an objective of smoothening and streamlining the erstwhile indirect tax structure and collection policy in India for better administration and transparency.

India’s tax to GDP ratio is 16.6% which is much lower than the emerging market economy average of 21% and OECD (Organization for economic co-operation and development) average of 34%. (Based on 2017 data)

Budget 2018-19: Tax specifics (Highlights and impacts)

For Corporate

Government has introduced some of the key changes in this years tax policy which would be in line with the objectives and principles of OECD (organization for economic co-operation and development).

DIRECT TAX

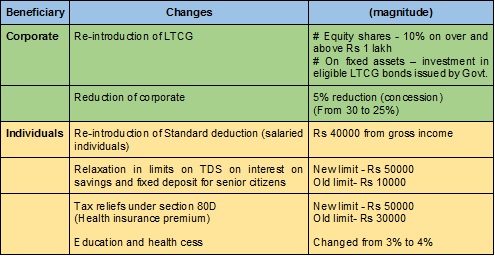

Reduction in corporate tax

1- One of the major changes in the tax policy this year for Corporates is the reduction of Corporate tax from 30% to 25% for businesses having turnover up to Rs. 250 Crore.

2- This concessional tax rate is applicable only to the domestic companies which are involved in specified business activities and thus would be eligible for deduction of the tax at this rate for income arising out of those activities.

Reintroduction of long term capital gain (LTCG)

On equity shares: Discontinuing the previous tax policy of exempting the corporates from paying tax on the long term gain in equity shares or any investment in equity mutual funds, the Govt. has now reintroduced the tax on such long term capital gain which would be 10%.

So, that means under the new tax policy if the profit out of any equity investments and increase in equity-shares value exceeding Rs 1 lakh would attract a tax of 10 percent by corporates if the concerned shares are sold any time after 1 year. This rate of 10% is applicable only where STT (securities transaction tax) which is a type of direct tax applicable on the consideration amount in transaction involving securities executed through a recognized stock exchange.

On fixed assets – Long term capital gain arising out of transactions involving selling and purchase of fixed assets like land and building would only be exempted from tax payment upon investment in purchasing eligible LTCG bonds specially issued by NHAI (National Highway authority of India) or RECL or any other bond notified by Government which would be redeemable after 5 years in spite of 3 years.

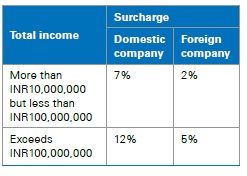

Table: Surcharge and cess for Companies

For Individual

Standard deduction – Though there have not been any changes in tax slabs for individual taxpayers, there is one significant change in tax payment for individuals wherein there would be a standard deduction (flat) of Rs 40000 from salaried employee’s income in lieu of key reimbursements like medical and transport etc.

This would also be a re-introduction of tax policy which was discontinued with effect from the assessment year 2006-07. Commenting on this move and its impact, knowing that this deduction would be there for every salaried individual despite the fact on actual claim by individuals in terms of reimbursements related to medical and transport, this is going to cost Govt. approximately Rs 8000 Crore benefitting 2.5 Crore salaried employees and pensioners.

Education and health cess – Increase in cess on incomes from 3% to 4% which would be deducted under the name of health and education cess and the increase revenue for the Govt. would be spent in the schemes/plans for growth and development of education and Below poverty line families.

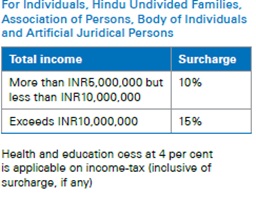

Table: Surcharge and cess for individuals

Tax relief and investment benefits – Increase in the exemption limit on the interest income by 500% (5 times the previous limit) to Rs 50000 per year and there would not be any TDS (Tax deducted at source) on interest for senior citizen.

Exemption under section 80D – Similarly, the limit of deduction for premium in health insurance for senior citizen has been increased to Rs 50000 from Rs 30000 and also the tax deduction for critical illness will be Rs 1 lakh from April 1, as against the existing limit of Rs 60,000 for senior citizens and Rs 80,000 for very senior citizens.

Termination of employment or change is terms and condition – Any compensation or receipt of amount in relation to individual’s termination of employment or change in terms and condition of employment would attract tax deduction.

INDIRECT TAX

Changes that would impact both the corporates and the individuals

There were other amendments in this year’s budget 2018-19 which would be having impact on both corporates and individuals some of them includes Increase in the basic customs duty (BCD) for few items like silica, glasses, electronic appliances like TV, mobile phones, vehicle (bikes & cars) engines, jewellery etc. This would lead to the increase in the prices of goods and commodities which would have an impact on the companies or industries which have related raw materials or inventory and similar would be the case with the individuals for whom these materials will get costlier than before.

Brief Summary (Key changes)

#ReadyBusinessPlan #Ask3EA #LearnAt3EA #3EA #BusinessPlan #CapacityEnhancement #CapacityBuilding #Capacity #Assessment #Global

#Tax #TaxStructureinIndia #IncomeTax #CorporateTax

Stay Connected: